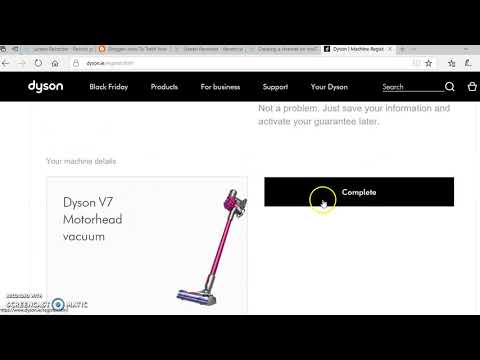

Hi everyone, my name is Monk Pennock. Hungry? My school project today is to show you how to register a Dyson warranty. The parts and labor warranty is for free with any Dyson product. So, go to the Dyson website, see tourney's, and then go to your Dyson's page. Just enter my address and the entire serial number for this machine. The serial number for this machine is: they enter the date of purchase. Yeah, emergency V7 attest about missing deputies. They take complete to fill the rest of the details. So, initially deter music number to see if I'll finish. Now, my two yahrens he puts a label for my destined to be seven Motorhead is registered in street. If you have to buy another machine, you can add it after. Just sign into your account and click on the cutting machine. That is it! I can cross that I get reviews on update about your Dyson's product. Also, update your profile in case we change our contact number, group post address, or jitters. Thank you so much, and I hope this will help you to know for better.

Award-winning PDF software

V10 Form: What You Should Know

Tax filing requirements depend on when you filed your most recent tax return. If you're a regular filer, you must complete Part I of Form 6251. If you are a non-filer, you will need to complete Part II of Form 6251. The rest of this lesson focuses on preparing Form 6251 for regular filers. Regular Schedule C or U filers : If you are a regular filer who needs additional information, the information on Part I and Part II can answer this question. If the information for line 21 is completed correctly, both Parts III and IV can be completed. If the information for line 21 is completely filled out, only Part IV can be completed. If you're a regular resident alien who's not a U.S. citizen, you should complete Part IV but not Part III. If you paid an AMT tax, you'll also need to fill out Part II if the information is completely filled out, and Part I if the information has been entered incorrectly. Specialty tax filers : If you pay the Medicare tax, you should complete Part III. If you are married and filing a joint Federal tax return, you should be able to complete Part III with some simple steps but Part V is not needed. Additional information : If you are filing more than one Form 6251, refer to Form 6251 instructions for details. If you have other questions concerning special tax forms with which you disagree, you can reach me at the address below. I try to help others whenever possible. I.A.G.M.S. P.O. Box 765 P.O. Box 765 Washington, D.C. 20021 I. P.A.E.N P.O. Box 3128 Newark, IN 46 I. V.C.I.S. 2500 East K Street Suite 900 Rockford, IL 61116 I-10/I-502 Tax Free Program (I-10/I-502) Department of the Treasury. Department of the Treasury. Form 8802A—Residency Exemption—Earning Potential I-10/I-502 Tax Free Program (I-10/I-502) Department of the Treasury.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form V62, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form V62 Online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form V62 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form V62 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing V10 form